*Disclosure: Some links included in this post are amazon affiliate links. This means that, at no additional cost to you, I will earn a small commission if you click through and make a purchase.

Filing…not a glamorous task, but one that can make your life easier! And, who doesn’t want that? All you need are some simple systems in place.

This time of year, in particular (tax season), can go much more smoothly if you have what you need right at your fingertips. And getting a handle on filing in everyday life means less stress and annoyance when you can’t find where in the world you put that _____ (directory, business card, bill – fill in the blank). Check out these Q&As.

Q: What supplies do I need to set up files?

A: I like hanging files – in a drawer or a box (whatever suits your fancy), with hanging files and paper files inside. I use a label maker to print labels that adhere to the plastic tabs.

You could get fancy by using different colored file folders and designating a category to each color. For example, red = financial, blue = home, yellow = work, green = kids, etc. Within each category would be more specific files such as home improvements, neighborhood association, or lawn in blue. But, beware of overcomplicating. Simpler is often better.

Here are some sources:

Cute hanging files/folders:

Standard hanging files/folders:

Label maker:

Q: What do I name my files to be sure I can find things later?

A: File by generic category such as “Electrician” instead of the electrician’s name or the business name, since that’s harder to remember. You’re aiming to strike a balance so that the name isn’t so generic that everything fits in there/file is too big/things are hard to find and yet isn’t so specific that it’s hard to maintain.

Q: My paperwork just piles up everywhere! How can I get on top of it?

A: A couple simple habit changes can help! Truth is, a million different filing methods can work. The keys are to have a system, and have a trigger to do the actual filing.

Think about the sources of your piles. Is it mail that doesn’t get handled as it comes in? School paperwork? What else? Think of all the things that could come into your home…greeting cards, ads, report cards, etc. For everything you need to keep, decide where it should go.

Handle the mail right away. Don’t keep any junk mail, catalogs, or any other paper that you don’t need. Recycle them when they come into your house. This should not take longer than a couple of minutes.

It’s ok to have a designated temporary holding area for each category of paper clutter until you get around to filing it (because….real life). Find some containers and label them “to file”, “to do”, perhaps another one “bills to pay” – whatever categories work for you.

Sort mail and other paperwork into these categories as soon as it comes into your home. Then, once a week, go through each of those zones and handle everything (do the filing, pay the bills, sign the permission slip, etc). Put it on your calendar, just like you would any other to do in your life.

Q: Any tips for filing kids’ special projects, keepsakes, and school papers?

A: Yes! Make a special box for each kiddo, with files for each grade/stage. Work with your kids to edit down to their favorites (and yours!) Check out this blog post for more information.

Q. How do I prepare needed documentation for taxes?

A: 2 things. 1. Have a master list of what you need AND 2. Keep a running file for the year.

Master List: Develop a list of things that you need for taxes, year in and year out. No need to reinvent the wheel. Categories could include charitable contributions, child care, property taxes, W-2s, investments, car registration, etc.

As you’re receiving your year end statements and pulling your documentation together, reference this list as a master checklist. That way, you’ll know when something is missing or what you have left to track down.

Tax File: At the beginning of each year, set up and label a file for the coming year. For example “Taxes 2020”. Keep a copy of your master checklist from above in your file. As applicable paperwork comes in throughout the year, put it in that file. Then, when it’s tax time, cross reference your master list with what you have in your tax file to be sure you have everything.

Q: How long should I keep important papers and tax documents?

A: There are things that I used to keep that I’ve realized just aren’t necessary. Common things to consider throwing away include receipts for minor purchases, manuals and warranties that can be found online, coupons past the expiration date.

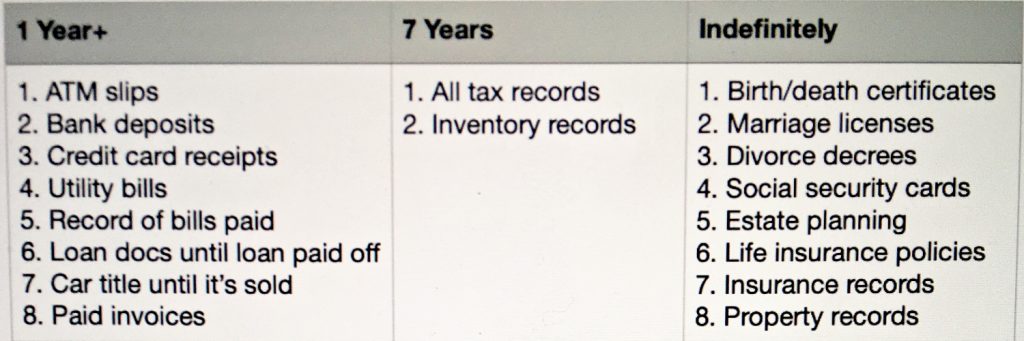

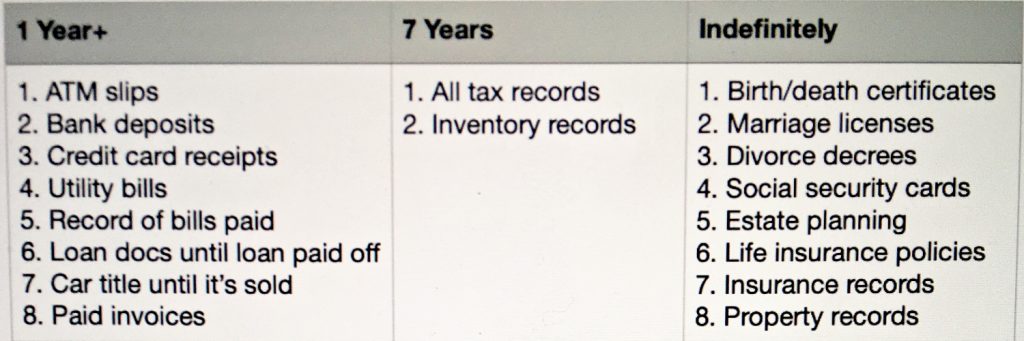

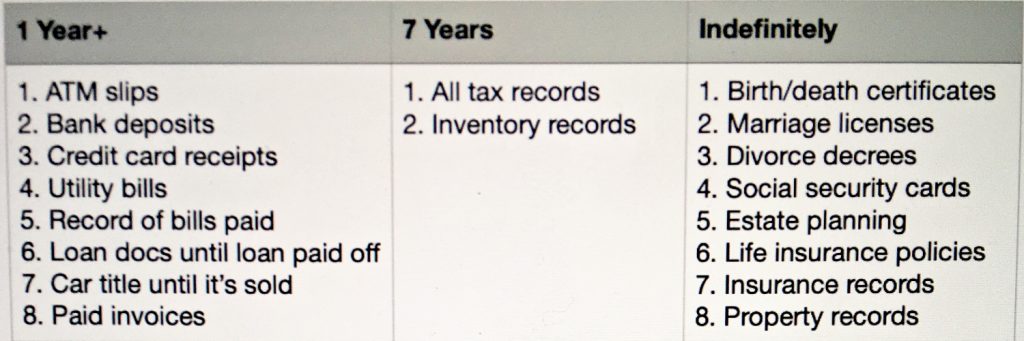

There are varying opinions as far as how long certain documents should be kept, but there are typically 3 distinct categories: less than 7 years, 7 years, and indefinitely. Here’s a guide to get you started. Check with a tax professional or other trusted advisor if you’re unsure of anything.

A yearly cleanup and shred session is a good idea. It’s helpful to have something that triggers you to do this. Right after filing for taxes is a good time. Schedule it into your calendar for April 15th and shred up that outdated paperwork.

Q: Should I use an electronic filing system?

A: It’s definitely an option. How and where you file really comes down to a matter of personal preference. I prefer to have hard copies of my tax docs, and most other categories as well. Many of the things I file come into my home already in paper form, so I find it easier to directly file them then to digitize them. Here are some digital resources if you’re looking to explore electronic options:

- Evernote – digitize, take notes, find information, scan magazine articles

- The Paper Tiger – manage digital and paper files

Either direction you go – electronic, paper, or a combination, the key is keeping up so you’re not holding on to things that are expired, not applicable, or you just no longer need. Consider putting quarterly appointments on your calendar for the next year to serve as prompts. Without that, it’s all too easy to forget about it.

Filing really doesn’t need to be intimidating! The hardest part is keeping up, but, once you have a filing system in place, designating a little time each day to stay on top of paper clutter will pay off in the long run.